Union Budget 2023-24: Important Facts and Major Highlights

The Finance Minister of India, Nirmala Sitharaman presented the first Budget of Amrit Kaal(the time period of the next 25 years). This year, the whole world was waiting for the Indian Budget 2023-24 because India is the only bright star shining in the dark night of geopolitical tensions and global recession. India is the only fastest-growing major economy in the world. It is projected that India's economy will grow at 7% in 2023 and at 6.5% in 2024. This year’s Budget is important because people were waiting to see important announcements for the Defence Budget. This year our hostilities with China increased including clashes at our eastern border.

Let us know about important facts and major highlights of Budget 2023-24.

What is a Budget and how is it prepared?

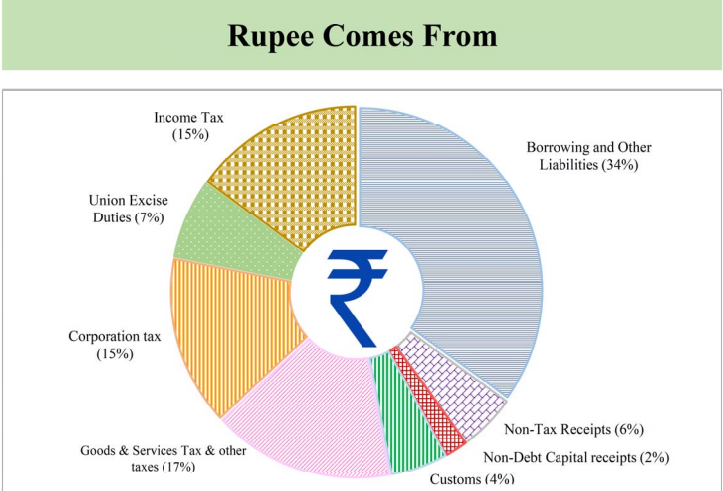

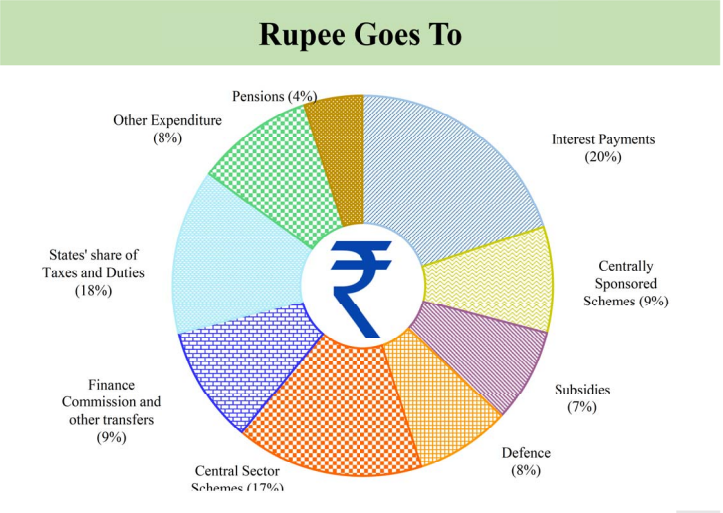

The budget is known as Annual Financial Statement mentioned under Article 112 of the Indian Constitution. The budget of a country is like the budget of your home. It consists of details of Income and expenditures. The budget also includes sources of income and where the income will be spent.

The budget is prepared by the Ministry of Finance after taking demands of Funds from various ministries. The Ministry of Finance scrutinizes this demand and allocates the Funds. But These Funds can be allocated with the permission of the president after passing the Budget in the parliament.

Some Major Facts about India’s Union Budget

- India’s First Budget was presented on 7 April 1860 by James Wilson who used to work under the East India Company.

- Independent India’s First Budget was presented on 26 November 1947 by R K Shanmukham Chetty.

- Finance Minister Nirmala Sitharaman holds the record for delivering the longest budget speech of 2 hours 42 Minutes.

- Former Prime Minister Morarji Desai holds the record for presenting the Budget the highest number of times. He has presented the Budget of India 10 times.

- Finance Minister Nirmala Sitharaman is the second woman after former PM Indira Gandhi to present India’s Budget. Nirmala Sitharaman will be presenting India’s Budget for the fifth time.

Major Highlights of Union Budget 2023-24

Major Highlights of Budget 2023-24 are the following as-

Defence Budget 2023-24-

- The total Allocation for Defence Budget is 5.94 Lakh Crore which is higher than 13% of last year’s allocation.

- 1.62 lakh Crore has been allocated for defence modernisation and infrastructure development.

- 1.38 Lakh Crore has been allocated for defence pensions.

- EEE (Exempt-Exempt-Exempt) Status has been provided to the Agniveer Fund. It means Agniveers will not have to pay any tax from their funds.

- 8500 Crore has been allocated for the development of roads in the border area by BRO (Border Road Organisation).

- 116 Crore has been allocated for research in the defence area.

Major Data Related to Union Budget 2023-24

Major Announcement on Personal Income Tax

- The Income Tax Exemption Limit increased to 3 Lakh and Income Limit for the Income Tax rebate has been increased to 7 Lakh from 5 Lakh.

|

New Income Tax Rate Announced in Budget 2023-24 |

|

|

Income |

Income Tax Rate |

|

3-6 Lakh |

5% |

|

6-9 Lakh |

10% |

|

9-12 Lakh |

15% |

|

12-15 lakh |

20% |

|

>15 Lakh |

30% |

Change in Tax Regime

â— E-Vechiles and Compressed Biogas have been exempted from

excise duty.

â— Mobile Phone Accessories have been exempted from customs duty.

â— Custom Duty on CIgerrates will be increased by 16%.

â— Custom Duty on Bicycles has been increased to 35% from 30%.

â— Custom Diuty on Silver and Jewelry Made of Silver increased to 10%.

â— There has been no change in custom duty on gold.

Budgetary Allocation to various sectors under Budget 2023-24

|

Budgetary Allocation to various sectors under Budget 2023-24

|

|

|

Sector/Ministry |

Allocated Amount |

|

Ministry of Defence |

5.94 Lakh Crore |

|

Ministry of Agriculture and Farmers Welfare |

1.25 Lakh Crore |

|

Ministry of Chemical and Fertilizer |

1.78 Lakh Crore |

|

Ministry of Consumer and Public Distribution |

2.06 Lakh Crore |

|

Ministry of Railways |

2.41 Lakh Crore |

|

Ministry of Health and Family Welfare |

86,175 Crore |

|

Ministry of Education |

1.12 lakh Crore |

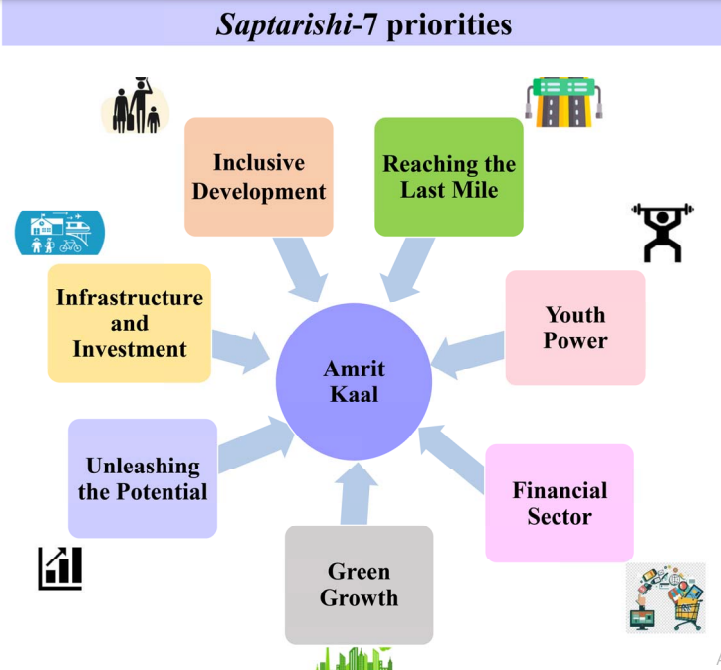

What is the meaning of Sapt Rishi or 7 Priorities in Union Budget 2023-24?

Sapth Rishi is the word used for the seven priorities highlighted under Union Budget 2023-24. These seven priorities will be the main focus of the Union Budget 2023-24.

Schemes Launched Under Union Budget 2023-24

- Gobar Dhan Scheme- Gobar Dhan Scheme aims at proper management and use of animal waste, agricultural waste, and organic waste. Waste will be used to make Biogas, Bio-CNG, and Compost.

- Bharat Shri Scheme- Under This Scheme Ancient Scripts and Inscriptions will be safeguarded and stored digitally.

- PM- PRANAM- PM Pranam Scheme aims at the reduction of usage of chemical fertilizers and incentivizes Farmers to use organic fertilizers.

- PM PVTG Development Mission- Under this Scheme, Particularly Vulnerable Tribal Groups’ socio-economic development will be ensured.

- Mahila Samman Bachat Patra- Mahila Samman Bachat Patra is a deposit scheme for women. Under this scheme, women can deposit money for a tenure of 2 years and they will be offered 7.5% of interest rate.

Importance of Union Budget 2023-24 for upcoming exams and SSB Interview

The Union Budget is a very important document for all the citizens of India. Every Citizen must know what their government is doing for them and their welfare. Defence aspirants must know facts associated with the Budget, its process and major announcements. Being a defence aspirant, candidates must know about Defence Budget also. In the defence budget, candidates must know the total allocation and outlay for research and innovation. Defence Guru has provided every possible details important for upcoming defence exams and SSB Interview.